Learn more below why you shouldn’t delay dental treatment, and what else we know about the federal government’s program.

What is the Canadian Dental Care Plan?

The Canadian Dental Care Plan (CDCP) is a federal government program that is intended to provide coverage for Canadian residents who do not have dental benefits and have a household income of less than $90,000 a year. You need to know that this is a government dental benefit; it is not a free dental program.

The CDCP is for Canadians who do not have dental benefits. It is not intended to replace benefits that people already have through work, school or private plans.

The CDCP is managed by Health Canada and administered by Sun Life. Dentists are not involved in deciding who is eligible or what services are covered.

Am I eligible?

The federal government is contacting groups of eligible citizens to inform them of the process. If you have not received a letter or other communication, you may not be eligible, or at least not yet.

Check your eligibility on the government website: https://www.canada.ca/en/services/benefits/dental/dental-care-plan/qualify.html

How much does the CDCP cover? Will my dental care be free?

No. The CDCP does not provide free dental care. It is a government dental benefit that covers a part of the cost of your care. You may have to pay the portion of costs that are not covered.

Patients may be required to make a co-payment (that is, pay for a portion of their dental care under the CDCP) depending on their adjusted family net income, as follows:

- No co-payment of the CDCP benefit for those with an adjusted annual family net income under $70,000.

- A 40 per cent co-payment of the CDCP benefit for those with an adjusted annual family net income between $70,000 and $79,999.

- A 60 per cent co-payment of the CDCP benefit for those with an adjusted annual family net income between $80,000 and $89,999.

Dentists have the choice to bill their usual and standard fees. In addition to the potential co-payment, you may have to pay the portion of a dentist’s usual and standard fees that aren’t covered by the CDCP.

When booking your dental appointment, talk to your dentist about the costs of your treatment and any costs that won’t be covered by the CDCP.

BCDA does not have further information about the additional fees that dental offices may individually choose to bill patients enrolled in the CDCP and cannot enter into a discussion about fees on your behalf.

How do I access the CDCP? When can I get my benefit?

The federal government is currently contacting the first groups of eligible citizens. Seniors who are eligible will receive letters from Service Canada inviting them to apply, with instructions on how to validate their eligibility and apply by telephone. Dental care under the CDCP began in May 2024.

Your coverage start date is based when on when you apply and when you’ll be enrolled in the CDCP. It will be different for each person.

In May 2024, an online application portal opened for seniors 65 and older. If you have a valid Disability Tax Credit certificate or have a child under the age of 18, you will be able to apply online starting on June 27, 2024. All remaining eligible Canadians will be able to apply online in 2025.

BCDA and any other dental associations do not run nor manage the CDCP; it is Government of Canada program. We cannot help you apply or answer questions about your eligibility for the CDCP. For more information on eligibility, visit canada.ca/dental.

What services will be covered by the CDCP?

Health Canada has stated that the following services could be covered under the CDCP, with some services only becoming available in the fall of 2024:

- Preventive services, including scaling (cleaning), polishing, sealants, and fluoride;

- Diagnostic services, including examinations and x-rays;

- Restorative services, including fillings;

- Endodontic services, including root canal treatments;

- Prosthodontic services, including complete and partial removable dentures;

- Periodontal services, including deep scaling; and

- Oral surgery services, including extractions.

Some services will require preauthorization, which means prior approval is needed. This will be based on a dentist’s recommendations. Before the treatment begins, your dentist will check to see if it will be covered under the CDCP. Services requiring preauthorization will become available in November 2024.

For full information on all services covered, go to the CDCP Dental Benefits Guide.

Can the CDCP replace my existing dental coverage through work or school?

No. The CDCP is designed for Canadian residents who do not have dental benefits. To qualify for the CDCP, you must not have access to any type of dental insurance or coverage through:

- Your employer or a family member’s employer benefits, including health and wellness accounts.

- A professional or student organization;

- Your pension benefits (previous employer) or a family member’s pension benefits.

- Exception: You may be eligible for the CDCP if you’re retired and you opted out of pension benefits before December 11, 2023, and you can’t opt back in under the pension rules.

- Coverage purchased by yourself or by a family member or through a group plan from an insurance or benefits company.

Did you know? If you’re eligible for dental coverage through your employment benefits or a professional or student organization, you are not eligible for CDCP. This is true even if you decide not to take it or use it.

The Canada Revenue Agency now requires employers to report on their T4/T4A whether their employees and their families had access to dental insurance coverage, including spending and wellness accounts.

BCDA does not recommend cancelling your existing dental coverage thinking that the CDCP will replace those benefits. Please take a careful look at your current coverage and how it compares to the CDCP. It may be that getting dental care with CDCP coverage is more costly than your private insurance. Make sure you understand all the details and costs of your coverage so that you can make the best decision for you and/or your family.

More details on whether you are eligible for the CDCP are on canada.ca/dental.

Will I lose my dental coverage at work when the CDCP starts?

We don’t know and this should concern us all. Two-thirds of Canadians have great dental benefits from their work, school, or other group plan. These plans give them a choice of dentist, and the right to choose what dental care they get.

Dentists believe that the CDCP should improve access to care for people who don’t have benefits. The CDCP should not take away the benefits that people already have.

A recent study showed that a third of Canadians would not support a dental care plan which causes them to lose their employer-provided dental coverage. This is why we need the federal government to tell us what they are planning to do to protect your existing dental benefits.

The government has stated that the CDCP is not intended to replace existing workplace or private dental benefits. The BCDA strongly encourages employers and other groups to keep the dental benefits for their employees and members, so they don’t lose access to care.

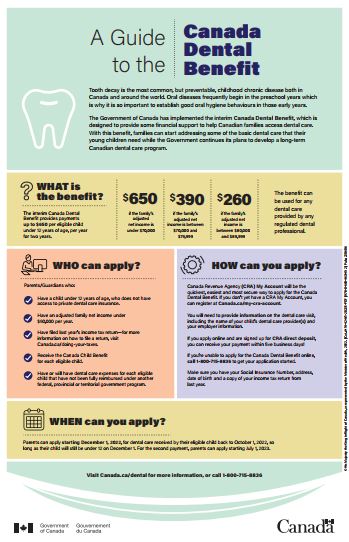

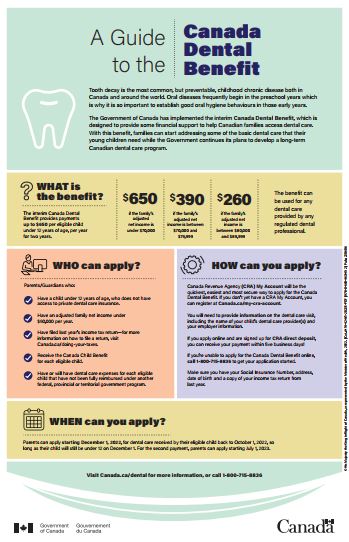

What is the Canada Dental Benefit (CDB)?

The interim Canada Dental Benefit is intended to help lower dental costs for eligible families earning less than $90,000 per year. Parents and guardians can apply if the child receiving dental care is under 12 years old and does not have access to a private dental insurance plan.

Depending on your adjusted family net income, a tax-free payment of $260, $390, or $650 is available for each eligible child. This interim dental benefit is only available for 2 periods. You can get a maximum of 2 payments for each eligible child. Benefit payments are administered by the Canada Revenue Agency (CRA).

The second benefit period is for children under 12 years old as of July 1, 2023, and receive dental care between July 1, 2023 and June 30, 2024.

Children on existing Provincial, Territorial or Federal dental plans remain eligible to apply, if they meet the eligibility criteria and Have out of pocket expenses for dental treatment that are not fully covered by these dental plans.

Learn more about the Canada Dental Benefit here:

Ready to apply? Visit the application portal on the federal government website.

Should I wait until I'm eligible for the CDCP to go to the dentist?

Don’t delay treatments or your dental appointments!

We understand some people are thinking of delaying dental care or rethinking their benefit coverage, hoping the costs will be covered by the CDCP.

It’s better to continue getting regular dental checkups now to catch problems before they become painful and expensive to treat, and apply for the plan when you are eligible to do so.

For more information on preventing dental problems, visit our Prevention page.

My dentist is not participating in the CDCP. Can they still treat me?

Your dentist can continue to provide you with the same level of care and treatment, but the costs won’t be covered by the CDCP.

Are applicants covered by provincial & territorial programs still eligible for the interim CDB?

Yes. We know that provincial and territorial programs do not cover dental care needs for children under 12 equally across Canada, and that in some cases, the programs focus only on emergency needs.

Children under 12 who are currently covered by provincial or territorial programs are still eligible for the interim Canada Dental Benefit so long as they have out-of-pocket costs for dental care services—costs which are not reimbursed under another federal, provincial or territorial government program—and if their family meets all of the criteria to qualify for the benefit.

Families should apply to their provincial or territorial program first (if applicable), and then, if there are remaining out-of-pocket costs that were not reimbursed by their province or territory, they can apply to the Canada Dental Benefit.

However, families whose needs are met by their provincial or territorial programs and do not have out-of-pocket costs are not eligible for the benefit and should not apply.

It's important that I see the dentist, but I can't afford to. What options do I have?

It’s very important to have an open dialogue with your dentist. Your dentist might be able to set up treatment and payment options that work with your financial situation. Talk to them to see what can be done to help.

What does the BCDA think of the CDCP?

The CDCP is intended to help millions of people without dental benefits access essential oral health care. Although this is an historic investment, the CDCP has been developed under tight timelines and with limited involvement of practising dentists. It's critical that the government has a full understanding of the impact it will have on patients trying to access the program.

Now that more details of the CDCP have been released, it’s time for the federal government to answer the big questions Canadians have:

- Am I getting free dental care? No – patients may pay out-of-pocket for services and fees that aren’t covered under the federal government’s new dental benefits plan, including 40 to 60 per cent co-payments for families who earn more than $70,000 per year. Where government reimbursement does not cover the full cost of care, some patients will pay the balance.

- Can I choose my own dentist? Maybe not – patients will have to search for dentists who agree to participate, despite the unclear terms and conditions set by the government.

- Will it be easy to get the care I need? Maybe not – dentists expect there will be a lot of red tape that may delay care and not make this a smooth process. Unlike other dental benefits programs, the CDCP has inserted processes that get in the way of how patients can access essential oral health care, and the relationship they have with their dentist.

The federal government has not answered other critical questions: How will they protect existing work, school and/or group dental benefits? How will the CDCP work with other publicly funded dental programs, including provincial programs? Without addressing these legitimate concerns, how do they expect people to know what this will mean for their dental coverage and what they should do next?

As experts in oral health care, the dental associations, representing over 25,000 dentists across the country, have pointed out that the CDCP does not meet most of the principles of our proposed framework. This is an historic investment, so it is critical that the federal government truly gets it right.

To learn more, read our latest media release.

Additional Canada Dental Benefit Resources

Download and print this 11"x17" factsheet (PDF, English) from Health Canada on your printer. It outlines the main aspects of the benefit in an easy-to-understand graphic. Also available in these languages:

Download and print this 11"x17" factsheet (PDF, English) from Health Canada on your printer. It outlines the main aspects of the benefit in an easy-to-understand graphic. Also available in these languages:

Dentists across the country share a common goal: to promote optimal dental and oral health for all Canadians. The Canadian Dental Care Plan (CDCP) is an historic opportunity to give all people in Canada increased access to dental care. If done right, the CDCP could be one of Canada’s greatest achievements in public health.

As the experts in oral health – and the healthcare providers who deliver dental care – we know what a good dental program should look like, and we want to help the federal government make the CDCP a success.

☑ Safeguard your access to dental care by respecting the current workplace, school and/or group dental insurance system.

Two-thirds of Canadians already enjoy world-class dental care, but some people must make difficult choices between their dental health and other important expenses. The CDCP is meant to help the latter group – providing dental care for those who don’t have insurance through their work, school, or other group coverage.

If employers start cutting or ending dental care benefits for their employees, it puts the whole program – and your oral health – at risk:

- The amount of people who would be forced onto the CDCP would grow dramatically and the cost for taxpayers will skyrocket beyond the $13 billion already budgeted.

- A family with a combined income of more than $90,000 could be left with no benefits at all.

The government needs to make sure businesses continue to offer dental care coverage to their employees so that the CDCP can help the remaining one-third of Canadians who don’t have any dental insurance.

☑ Allow you to choose your own dentist in your community.

Patients should be able to choose their dentist. That is why the CDCP should be delivered through existing dental offices. You should be able to stay with your dentist, who knows you and your background. If you don’t have a regular dentist, you should be able to choose one who practices in your community, whose office meets your needs, and who, in some cases, can speak your language.

☑ Ensure you can access the dental care you need without having to deal with needless administrative delays and red tape.

Patients accessing care under the CDCP should be able to get the dental care they need, when they need it – the same way people with workplace benefits do. This means the CDCP should allow patients to make decisions about their own care in partnership with their dentist. It should also have easy enrollment or registration, a quick claims process, and minimal paperwork.

Most dental offices have electronic systems to submit claims and payments between patients, dentists, and insurance companies. Most people do not have to fill out forms and wait for the government to approve their care before they can receive it. An accessible public dental care program should operate in the same way.

☑ Work with existing government dental programs so you can get the most out of the dental care you’re entitled to.

Most provinces and territories already have public dental care programs for families and children with low incomes, seniors and/or people with disabilities. We know the ins-and-outs of these programs because we treat the patients who depend on them. We can help inform the federal government so that the CDCP and existing provincial/territorial government dental programs work together for the people who rely on them.

☑ Fairly compensate the dental professionals who deliver the care.

Provincial and territorial dental associations have suggested fee guides developed by third-party experts. The suggested fee guides help dentists independently set fees for their practices that are fair, transparent, and predictable to both dentists and patients. By aligning the CDCP with the fee guides, dentists can continue to provide effective, equitable, high-quality dental care that all patients expect and deserve, regardless of their income.

In addition to the proposed framework, we urge the federal government to:

☑ Implement a coordinated plan to increase skilled labour for dental offices.

There are already serious shortages of dental hygienists and dental assistants across Canada. The CDCP will dramatically increase staffing demands in dental practices. Without enough of these skilled professionals, you could face delays in getting the dental care you need.

Until the federal government can deliver a strong CDCP, we recommend at least a temporary expansion of an initiative that is already working for Canadians – the Canada Dental Benefit. This is a fixed dollar amount that a patient can use to be reimbursed for dental-related expenses. Nearly nine out of 10 Canadians support the Canada Dental Benefit, and public surveys suggest that most would support an oral health spending account as a permanent solution.

The dentists of Canada want to champion a CDCP that will respect patients, providers, and taxpayers. We all deserve a plan that works.

Download or print the above Checklist and Overview (PDF).